Takaful Vs Conventional Insurance

Conventional insurance most islamic jurists conclude that conventional insurance is unacceptable in islam because it does not conform with sharia for the following reasons.

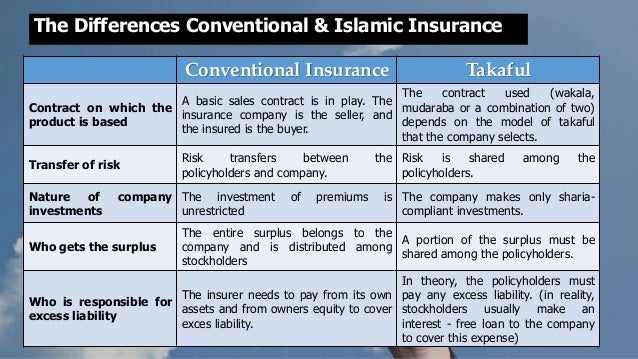

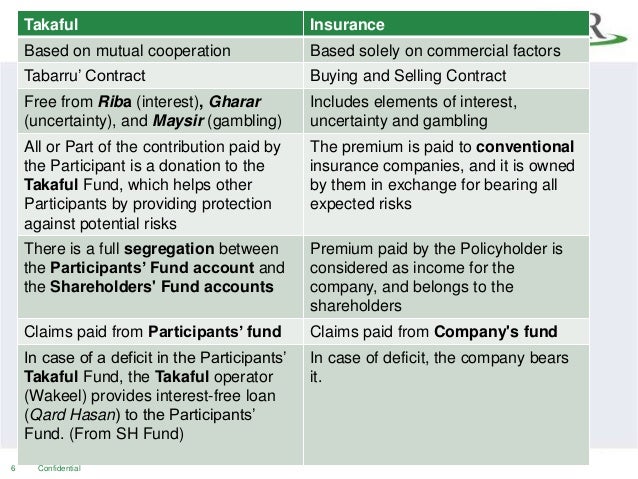

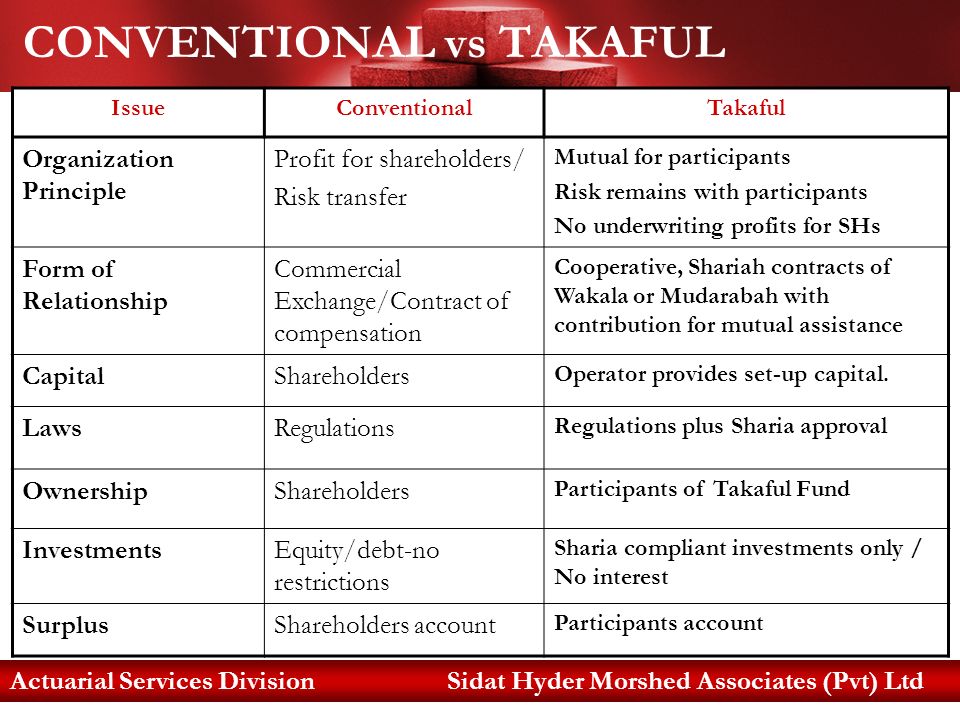

Takaful vs conventional insurance. In theory this means that a takaful entity must ensure that both its policyholder and shareholder fundsmustbeinvested inassetswhichdonothaveribaandthatanybankthatthetakafulentity. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below. Intent individual enters the agreement to contribute to a fund that can potentially help those experiencing the unfortunate situation.

The wakalah charge is similar to a service fee. Both takaful and conventional insurance policies work on the same basic system which is the pooling of funds to manage the risk of a group of people. Other differences are the relationship between the operators and the participants.

Bermakna kalau apa apa yang buruk berlaku tabung takaful mampu bertahan lama. If you are looking for insurance plans whether conventional or takaful based do have a gander at our comparison page first to discover the most affordable plans with the best terms. Having said that there are major differences in the workings of the two systems stemming from the fact that takaful adheres strictly to the islamic principles it was developed upon.

The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund. Conventional insurance involves making investments that can incur risk and generate profits that will be retained by the company while under takaful investment profits are distributed among both participants and shareholders on the basis of mudaraba or wakala models. Conventional insurance typically charges a fixed commission fee of 2 whereas takaful operators might impose a wakalah charge depending on the product and model.

Premiums and contributions for both conventional and takaful policies can be claimed for tax relief for medical life and child education policies. Syarikat takaful yang popular sudah lama bertapak dan dikenali ramai mempunyai dana takaful yang besar. Takaful pakistan limited takaful pakistan takaful karachi family takaful to spread takaful benefits beyond borders beyond time.