Sst How Many Percent

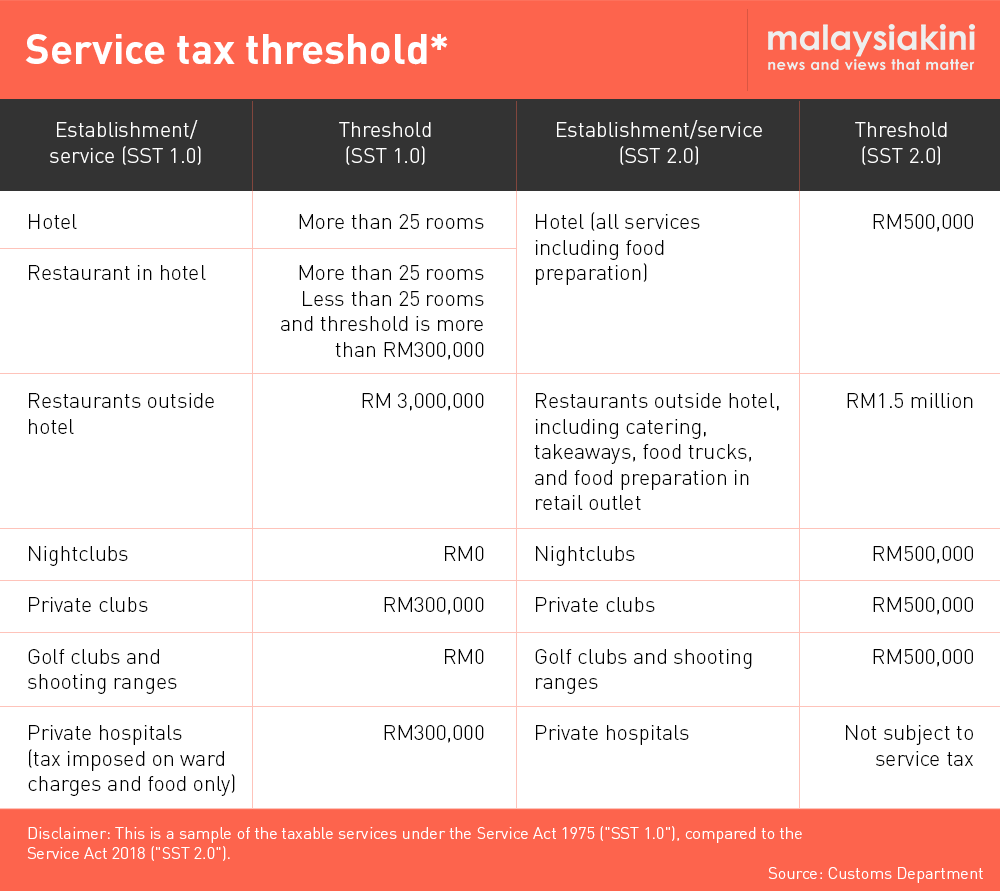

The sst threshold for operators of restaurants bars canteens cafes or any place that provides food and drinks are subject to a rm1 500 000 threshold.

Sst how many percent. Statistical data 1 2 3 4 5. Some experts believe that more tax may not be collected under the new method. Sst is an ad valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services.

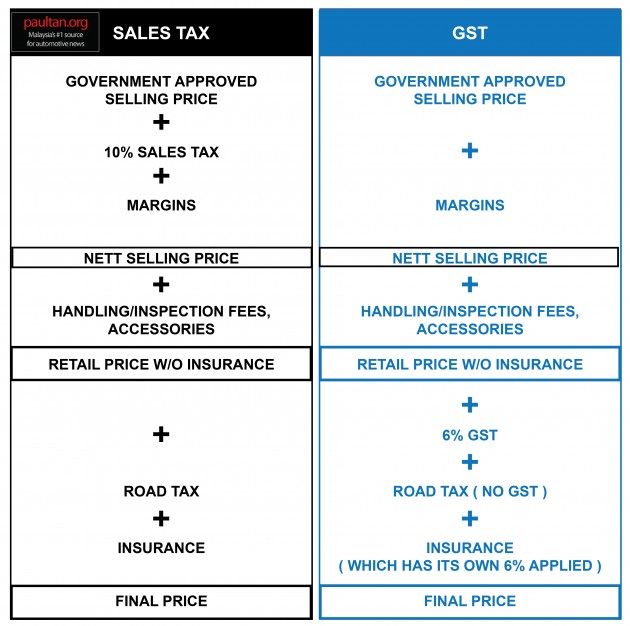

Sst 02 sst 02a return manual submission more 28 10 2020 sales tax service tax guide on return payment more 14 10 2020 guide on accommodation more. What is the sst. The previous gst regime introduced on april 1st 2015 covered a broader range of items and services at a 6 percent rate.

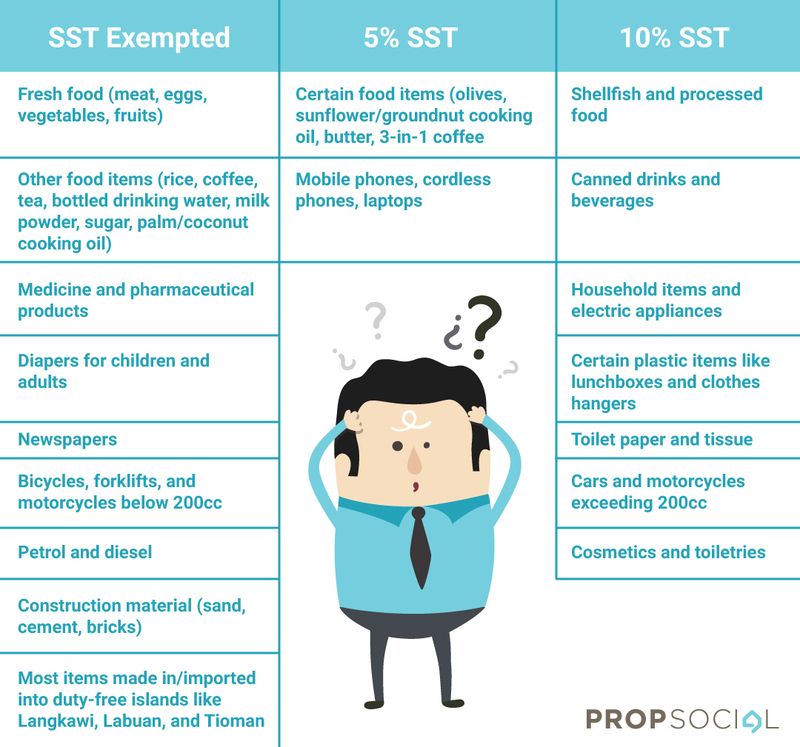

New methods like hiit or polarized training have been proven far more effective and time efficient to sst. Sales and services tax sst the sales tax is only imposed on the manufacturer level the service tax is imposed on consumers that are using tax services. 5 for fruit juices basic foodstuffs building materials personal computers telephone and watches.

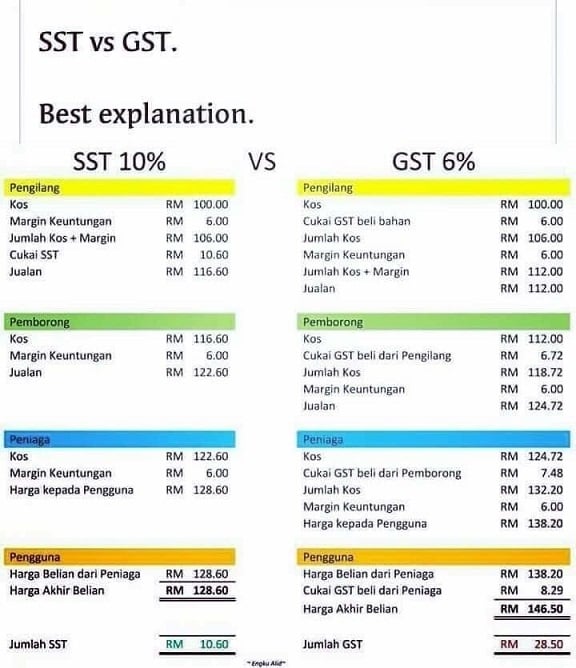

It may seem that 6 percent is lower than 10 percent but in reality more money will come from gst because not all sales and services are taxed under the sst. Some coaches call it a black hole. Under the new sst goods are taxed between 5 to 10 percent and services at 6 percent.

November 27 2018 07 38 reply. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018.

The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. Sales and service tax sst in malaysia. The sum of squares total denoted sst is the squared differences between the observed dependent variable and its mean you can think of this as the dispersion of the observed variables around the mean much like the variance in descriptive statistics.