Sspn Tax Relief 2020

For skim simpanan pendidikan nasional sspn savings and private retirement scheme prs contributions.

Sspn tax relief 2020. The skim simpanan pendidikan nasional sspn or the national educations savings scheme is a savings plan introduced by ptptn to enable parents to invest for their children s higher education. Sspn is an education saving scheme introduced by ptptn perbadanan tabung pendidikan tinggi nasional. You can claim tax relief for the net deposit in sspn up to the claim limitation if your total deposit for the year 2019 is higher than your total withdrawal.

This was announced by finance minister lim guan eng last year during the announcement of budget 2019. Finance minister tengku zafrul aziz has announced that extension of two tax reliefs in particular. Sspn i plus 2020 launched on july 14 with a total of rm1mil cash prize and a mercedes benz c200 as the main prize is to encourage the public to save in sspn i plus in addition to showing appreciation to committed depositors who make consistent savings deposits and plan for their children s future education.

You can claim tax relief for the net deposit in sspn up to the claim limitation if your total deposit for the year 2019 is higher than your total withdrawal. Ibu bapa dan ibu bapa angkat penjaga yang sah dari segi undang undang yang menyimpan dalam akaun sspn i untuk manfaat anak diberi pelepasan sehingga maksimum rm8 000 00 setahun tertakluk kepada jumlah simpanan bersih tahun semasa. The aim of the cabutan wow.

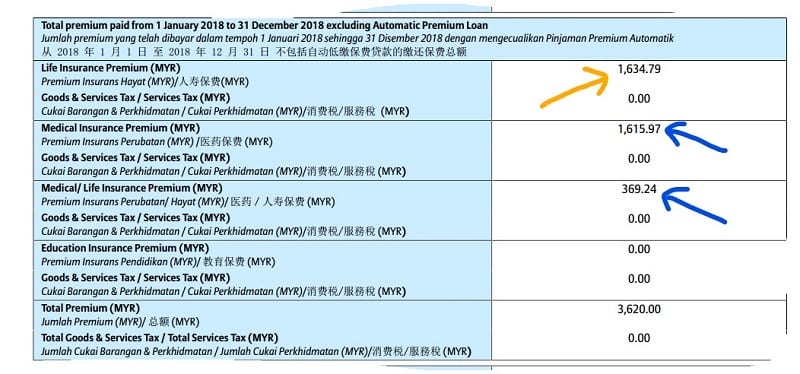

Personal tax relief malaysia 2020. One of the incentives includes maintaining tax relief of up to rm8 000 for deposits to the national education savings scheme sspn with an extension until the 2022 tax assessment year. The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments.

To encourage saving for retirement the rm3 000 tax relief on private retirement scheme prs contributions has. This means that the maximum tax relief from sspn i new deposits will remain as rm6 000 until assessment year 2020. Pelepasan taksiran cukai pendapatan ke atas simpanan sspn i.

As such parents who opt for savings under sspn i plus are eligible to receive tax relief for deposits up to rm11 000 rm8 000 for the net savings under the sspn i plus and rm3 000 in takaful contribution. Sspn contributors laud the government s initiative parents are encouraged to start saving early for their children s education. Now the good news is national budget 2018 announced on 27 october 2017 has further extended this sspn i maximum rm6 000 tax relief period for another 3 years which will continue from assessment year 2018 until 2020.