Sole Proprietorship In Malay

Human translations with examples.

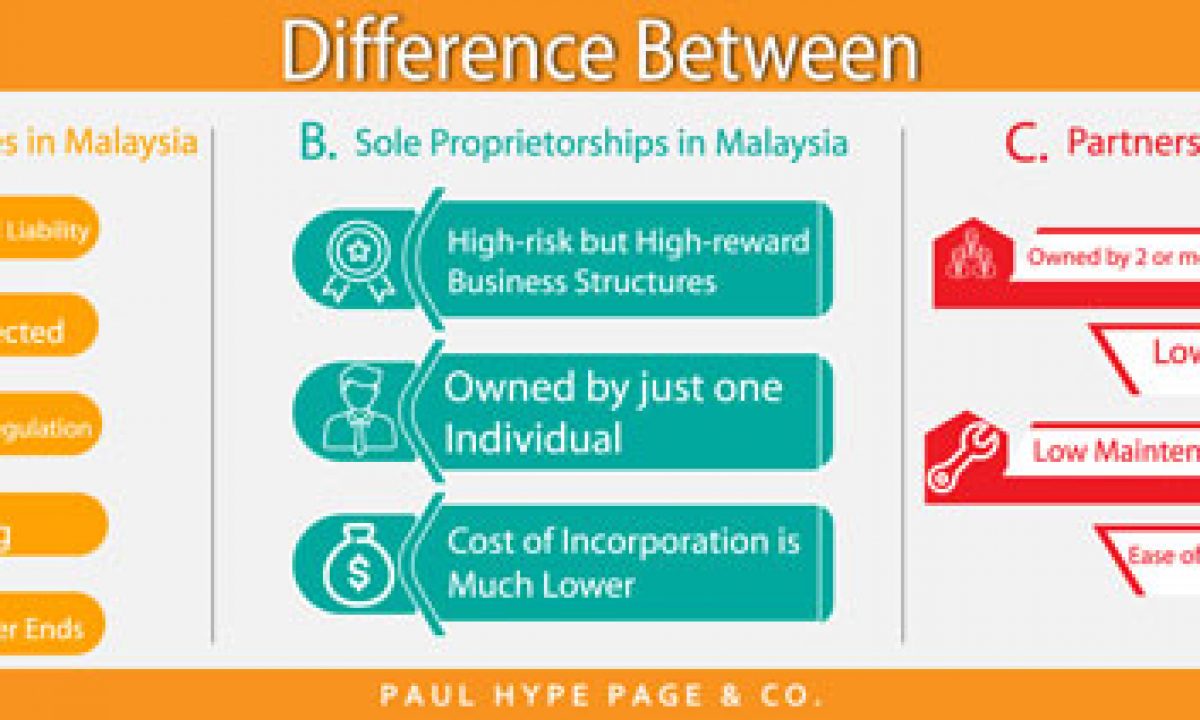

Sole proprietorship in malay. Business wholly owned by a single individual using personal name as per his her identity card or trade name. Self employed sole proprietors partners. Register a sole proprietorship in malaysia a sole proprietorship must be registered with the companies commission malaysia the main institution where companies file for registration.

Sole proprietorships are pass through entities. Contextual translation of sole proprietorship into malay. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person.

To register a sole proprietorship in malaysia the following criteria must be fulfilled. Waist broker kongsi tunggal kamus dewan halibut fish ikan tunggal. A sole trader is represented by the natural person who will carry business operations in his or her own name.

Benefits of sole proprietorship in malaysia you are the sole owner so you will enjoy all the benefits and profits made by your company and need not to share with anyone. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business. Anonymous is a sole proprietorship company established on july 21st 2011 which is a class g4 electrical engineering contractor pkk and has been registered with cidb grade g4 1001 a 2012 e019 cidb ministry of finance malaysia and the malaysian energy commission.

All profits and losses go directly to the business owner. The owner must be a malaysian citizen or permanent resident of malaysia the owner must be aged 18 years and above only the owner is allowed to apply. Sole proprietorship malaysia comes with enticing policies where the owner of the company doesn t need to corporate tax.

How to start a business. Owners of sole proprietorship experience unlimited liability which means that if the business fails to survive or declares bankruptcy creditors will be able to sue the business owners for all the debts which are owed. Thereby no separate tax return file is needed.