Sme Bank Business Loan

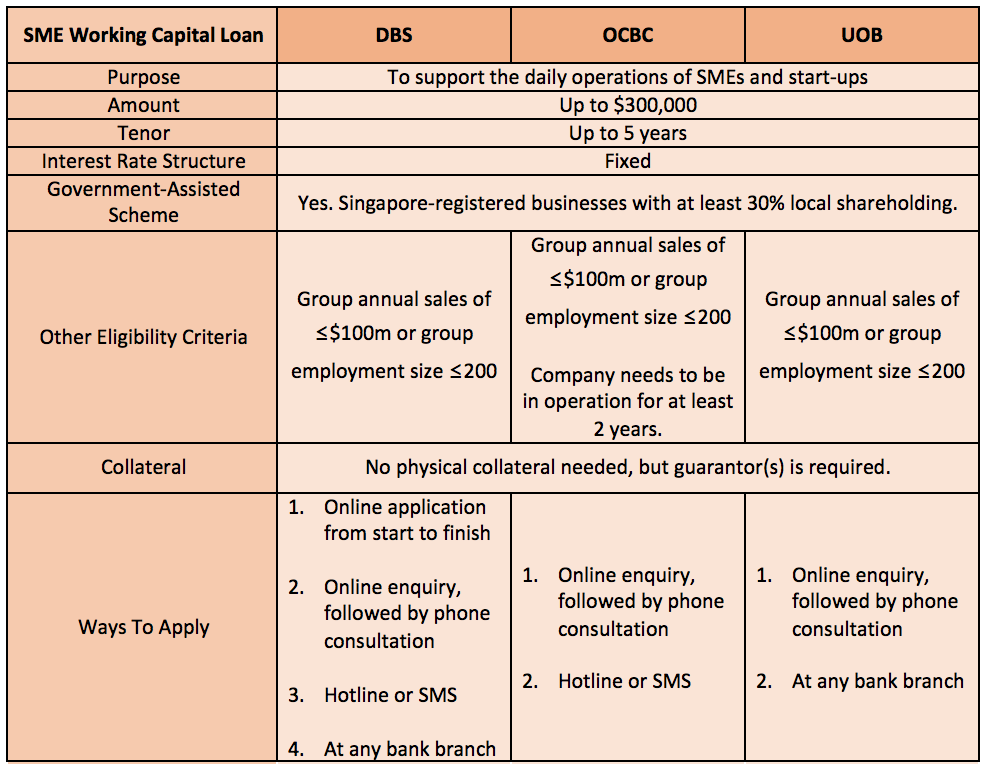

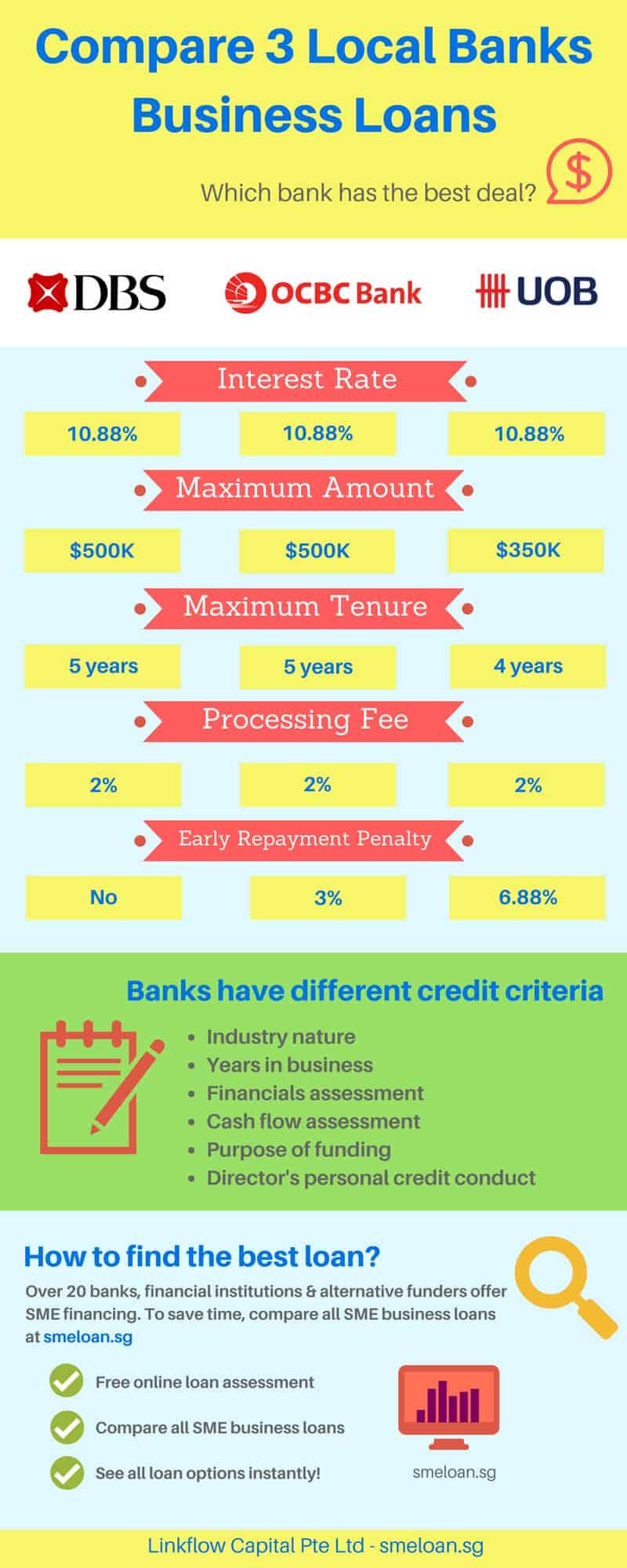

If your business requires only a small loan say under s 200 000 you might want to check out these three sme loans.

Sme bank business loan. Business loan online application to grow your business is now simpler faster and smarter with dbs sme banking. Ocbc s business first loan offers up to s 100 000 with a maximum tenure of 4 years. Small business financing sbf to assist entrepreneurs on their working capital needs.

Find out how to rev up your sme here. Ocbc s business first loan. Public bank accepts the abm sme loan application form and checklist of documents submitted by customer.

Subordinated financing programme sfp support to empower sustain bumiputera s economy in business. Improve your operations and enhance your cashflow with the collateral free business loan facility of dbs. Dbs business banking services comprises new account opening online business loan equipment loan trade collections a wide range of banking products for sme.

We offer finance for business growth and expansion together with accounts that meet your daily business needs or earn you interest on spare cash and innovate solutions that provide safe fast and convenient banking. Apply micro loan commerical industrial property loan. Small business financing sbf to assist entrepreneurs on their working capital needs.

Uob sme loan ocbc business first loan and dbs digital business loan. However public bank has our own application forms which can be obtained at our bank branches. Sme business loan a general purpose term loan designed to meet a wide variety of business purpose for smes from one off purchase of stock through to additional cash flow for your business short term finance.

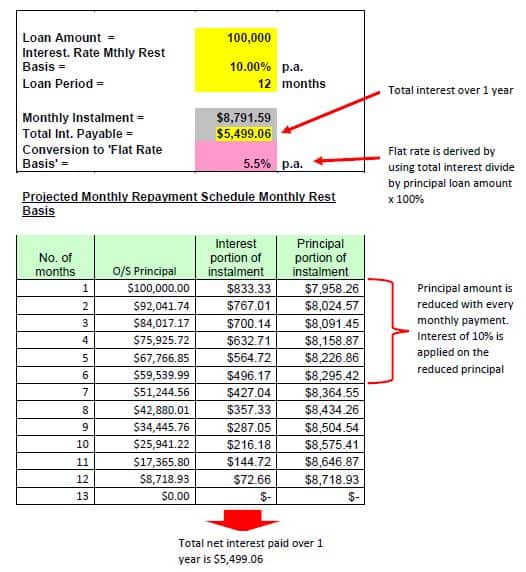

Fixed interest rate calculated daily charged monthly. Business accelerator program bap to assist smes in strengthening their core business building capacity and capability and facilitating access to financing. Loans from k5 000 to k500 000.